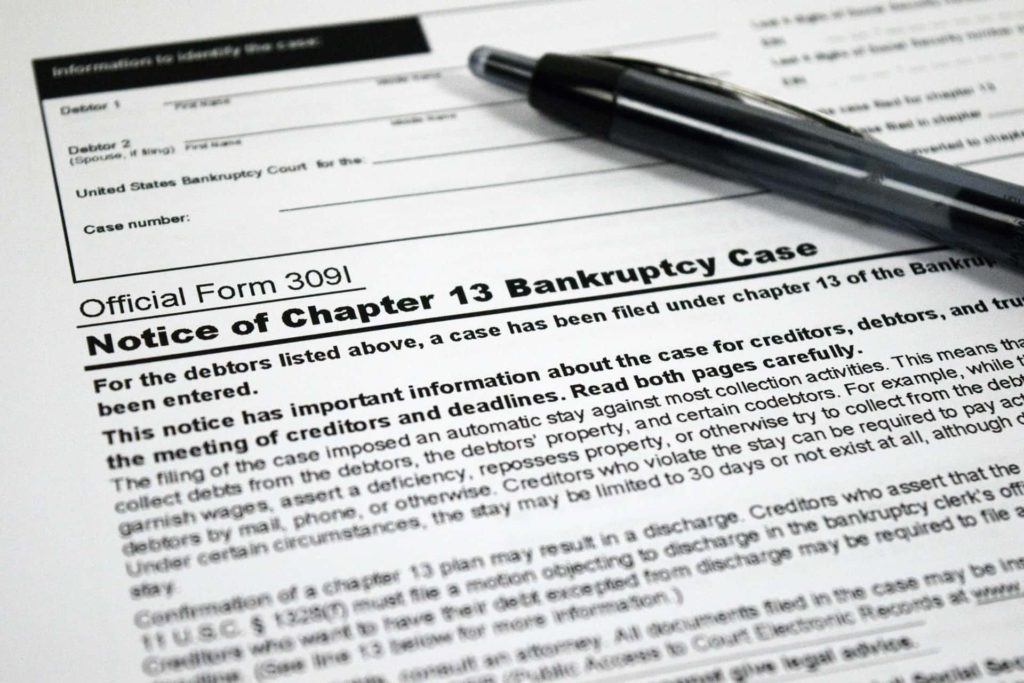

What Happens After a Chapter 13 Bankruptcy?

There’s much to consider following the closure of a Chapter 13 bankruptcy proceeding and repayment plan. You may be able to pay off more debt than you think, but your credit score will take a significant hit as a result.

5 Things to Know About Chapter 7 and 13 Bankruptcy

There are a lot of facts – along with a lot of myths – out there about individual bankruptcy. This post highlights five facts anyone considering either should know about what happens in Chapter 7 and Chapter 13 proceedings.

Investment Real Estate Issues in Chapter 7 and 13 Bankruptcies

Real estate ownership plays a big role in paying back debts to creditors through a Chapter 13 Bankruptcy proceeding. There are specific rules and requirements to follow in order to keep property and other assets.

How to Know if Chapter 11 Bankruptcy is Right For Your Business

Understanding the basics of Chapter 11 Bankruptcy is the first step in determining if this path is right for you. There are a lot of variables that go into the decisions, so it’s important to talk with a qualified bankruptcy attorney.